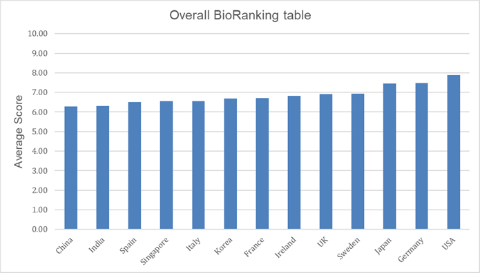

Bio processing and manufacturing league table ranks US top and China bottom

US, Germany and Japan revealed as tier one nations in all categories with Sweden ranking the best of the rest.

bioLIVE – the new bioprocessing and manufacturing event running alongside this year’s CPHI Worldwide – announces the initial findings of the world’s first ever biopharma league table, which evaluates the reputations of major bio manufacturing countries across a number of characteristics (scored 1-10). This follows the launch of the small molecule pharma league table introduced last year.

Most surprising are the results of China – a nation that has seen a well-documented surge in both innovative biotech start-ups and bioprocessing and manufacturing companies – whose reputation in biologics is still far behind the more established players. China scored below 6 for ‘bio innovation’ and ‘quality of biological manufacturing’ – bottom in both respective league tables – suggesting perception here may lag behind reality.

bioLIVE expert, Dawn M. Ecker of BioProcess Technology Consultants, commented: “If we look at quality and innovation – both important attributes for advancing bioprocessing technologies – the US, Germany and Japan are ranked highest, followed by several other European countries, where biomanufacturing is a mature industry. China and India, both burgeoning markets for biologics, were not ranked as high for innovation. This perception may relate to the still developing biologics and bioprocessing industry in these regions, coupled with the knowledge of their existing reputations for mass production of generics.”

The full findings from 500 companies will be announced during bioLIVE in Madrid (October 9-11, 2018), with host nation Spain scoring just above 6 for all categories – significantly behind the other four major EU economies, as well as Ireland. In fact, recent training initiatives by Ireland’s NIBRT (National Institute for Bioprocessing Research) may be paying dividends as the country scored highly on ‘knowledge of bio professionals’ (7.2), and second only to Germany in terms of ‘growth potential’ (7.0) amongst EU countries.

Ecker, however, felt Ireland should have performed even more strongly. “Surprisingly, Ireland did not score as high as other European countries, despite the strong presence of biopharma manufacturing and the significant number of biomanufacturing facilities to be built here in the coming years. In this case, perception may be related to the increased demand for skilled staff, with not enough skilled staff to support the projected additional capacity growth”.

Overall, when performance across all categories is analyzed, the USA (7.88), Germany (7.49) and Japan (7.46) again appear as tier one nations – mirroring the results in small molecule manufacturing – with Sweden (6.95) and the United Kingdom (6.91), ranking as the best of the rest.

The most notable difference between small and large molecule rankings was amongst the performance of mid to high ranking countries with Sweden (6.95), Singapore (6.54), and notably, South Korea (6.69) – home of a growing biopharma sector including Samsung Biologics – performing comparably to France (6.72), Spain (6.51), Italy (6.55) and Ireland (6.81) in terms of biologics. India (6.31) and China (6.29) were adrift at the foot of the table – however, given the larger number of Indian participants in the survey data, India would finish behind China, if Indian participants were excluded.

Rutger Oudejans, Brand Director at bioLIVE added: “We are increasingly seeing a lot more bio professionals at CPHI and to announce the launch of our new bio processing and manufacturing event we wanted to explore what role reputation and perception may play. With bioprocessing and outsourcing set to rise quickly over the next few years, partnerships and investment decisions may well be impacted by the perceived status of nations verses the reality of their capabilities. We have also seen across all economies a shortage of qualified personal so certainly initiatives like NIBRT who are giving a couple of session at this year’s event will become increasingly important. Overall, our results suggest that whilst the US is clearly ahead, the majority of countries scored between 6 and 7, and it was very, very even. It suggests it’s a very level playing field in terms of business opportunities and that attendees at bioLIVE will be open to working with a very diverse supply chain.”

Related News

-

News Pharmapack Awards 2024 Patient-Centric Design Award Winner – Dr Ferrer BioPharma

The 2024 Pharmapack Awards celebrated the best in innovation and design for the pharmaceutical packaging and drug delivery industry on January 24, 2024. -

News Women in Pharma: Minding the Gap at Pharmapack 2024

2024 marks the first year Pharmapack will host a Diversity track dedicated to bridging the gap within the pharmaceutical packaging and drug delivery sector. The track includes a panel discussion on 'Enabling Diversity in the Workplace,' focused... -

News Pharmapack Awards 2024 - Celebrating Packaging and Drug Delivery Innovation

The 2024 Pharmapack Innovation Awards ceremony celebrated the best in pharmaceutical packaging and drug delivery innovation at all levels. The awards were held on January 24, 2024 at the Paris Expo Porte de Versailles. -

News 2024 Pharma Industry Trends Outlook: Collaboration, Market Maturity, and Digital Futures

The annual CPHI Online 2024 Pharma Trends Outlook, in partnership with Arvato Systems, identifies 12 key industry trends shaping the life sciences industry in the coming year. -

News New Novo Nordisk AI hub for drug discovery to open in London, UK

Danish pharmaceutical giant Novo Nordisk will be opening an AI-based research facility in the heart of London to advance drug discovery operations. -

News BioNTech to begin mRNA vaccine manufacturing in Rwanda by 2025

German biotechnology company BioNTech has stated their intentions to begin production at their mRNA vaccine factory in Rwanda by 2025, which will mark the first foreign mRNA vaccine manufacturing site on the continent of Africa. -

News Women in Pharma: Looking back on 2023 and moving forward to 2024

In this monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. -

News CPHI Barcelona 2023: Partnering for Success – Managing Outsourcing Relationships to Optimise Manufacturing Operations

During CPHI Barcelona 2023, insightful content sessions offered attendees the chance to explore trending topics with expert speakers and panellists. Here, we summarise what the pharma industry and supply chain are talking about the most.

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance