High-potency monoclonal antibody therapeutics find application scope in precision medicine

Technology convergence through partnerships, mergers and acquisitions is yielding a stream of strong candidates, finds Frost & Sullivan.

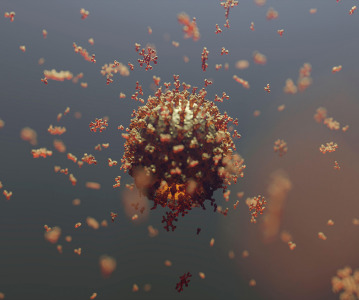

Next-generation monoclonal antibody-based platforms are gaining momentum and expected to impact patient care, particularly in the field of precision medicine. Antibody therapeutics are evidencing continuous evolution over time, especially in terms of its potency against disease targets, ability to treat more than one aspect of a disease simultaneously, enhanced and less expensive production processes as well as fewer side effects.

New analysis from Frost & Sullivan, Advances in Monoclonal Antibody Therapeutics, finds monoclonal antibody therapeutics have received extensive attention in the past two decades. Currently, there are 50 monoclonal antibody drugs in the market and the competition among large biopharmaceutical companies is aggressive. More than 500 companies populate this space, developing novel discovery platforms and bioinformatics resources, among other products. In addition, contract manufacturing companies are becoming increasingly popular. Overall, the global monoclonal antibody therapeutics market expects to expand at a compound annual growth rate of 8.1% during 2014 through 2020.

Monoclonal antibody therapeutics are being used for the treatment of a wide variety of diseases, especially in the following areas:

The development of new molecular agents with high specificity is playing a crucial role in the growth of the pharmaceuticals industry.

“Efforts to create advanced molecular agents indicate the top biopharmaceutical companies’ strong focus on biologics,” said TechVision Industry Analyst Cecilia Van Cauwenberghe. “However, during cell line generation, which is an important part of the molecular agent development process, it will be challenging to ensure the optimization of the cell expression system to increase capacity.”

On the other hand, the approval of biologics may affect competing therapeutics. A significant concern for the competition is the cost of developing and producing biologics is remarkably higher than conventional small molecule medications. Furthermore, there is a need for investments in biologics infrastructure and manufacturing.

Big pharmaceutical companies are advancing through potentially lucrative deals to acquire antibody technologies, compensating for patent losses in traditional molecules and making it easier to tackle the advent of biosimilars. They are resorting to mergers and acquisitions as well as partnership and collaboration activities with top-tier players, highly innovative small and medium-sized biotech companies, governmental institutions and leader venture capitals to gain access to the latest developments in monoclonal antibody therapeutics.

“Partnership deals and agreements are adding impetus to technology synergy,” concluded Van Cauwenberghe. “As a result, high-potency products such as ultrapotent antibodies obtained by replacing amino acids, bispecific antibodies and antibody fragments, as well as, glycoengineered antibodies and other innovative solutions are gaining increasing attention.”

Advances in Monoclonal Antibody Therapeutics, a part of the TechVision subscription, provides expert opinions on the emerging trends in monoclonal antibody therapeutics globally, through a detailed strategic assessment of the industry environment.

Frost & Sullivan's global TechVision practice is focused on innovation, disruption and convergence and provides a variety of technology based alerts, newsletters and research services as well as growth consulting services. Its premier offering, the TechVision program, identifies and evaluates the most valuable emerging and disruptive technologies enabling products with near-term potential. A unique feature of the TechVision program is an annual selection of 50 technologies that can generate convergence scenarios, possibly disrupt the innovation landscape, and drive transformational growth.

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)