Lonza’s Re-Positioning Continues to Drive Improving Results

In the first half of 2015, Lonza’s Specialty Ingredients and Pharma&Biotech segments both delivered a strong and improved performance and are on track to deliver their growth targets. Compared with the same period in 2014, sales growth of 6.1% to CHF 1,910 million in constant exchange rates (5.8% in reported currency) and CORE EBIT growth of 8.3% in constant exchange rates to CHF 261 million (7.9% in reported currency to CHF 260 million) are coming from improved operational performance and the implementation of market-driven activities.

“Our customer- and market-orientation, as well as our positioning as a high-quality, innovative and reliable supplier, are all gaining momentum now, as our strong overall results confirm,” said Richard Ridinger, CEO of Lonza. “This steady improvement gives us the stability to look at further optimization of our portfolio and our asset footprint, including consolidation of our expertise into specific sites.”

One of the key developments in the first half of 2015 was the Swiss National Bank’s lifting of the ceiling of the Swiss franc to the Euro. Since the acquisition of Arch Chemicals, Lonza has improved the natural hedge globally from a sales-versus-costs perspective for nearly all our trading currencies; so Lonza is less exposed from a Group point of view than in previous years. Remaining foreign-exchange effects are being managed through business performance and counter-measures.

In Visp (CH), however, Lonza risks being less competitive because of the Swiss franc-related fixed cost base there; so it has continued the existing Visp Challenge program started in 2012. The solid basis of this program allowed us to take a careful approach to the current challenges and to find dedicated, well-targeted measures, such as further automation, slight adaptations to its capacity offering in lower-margin assets and portfolio adaptations. Thus, the company implemented a hiring freeze in specific areas that will allow it to reduce the workforce through natural attrition and balance the Euro foreign exchange impact. Over time these actions will lead to a reduction of about 90 positions, and further efficiency and productivity measures will continue to be implemented.

Pharma&Biotech Segment

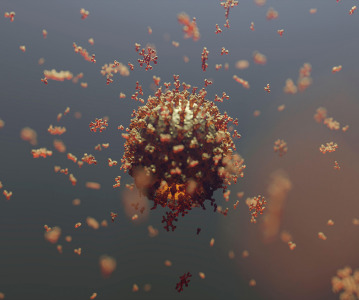

Pharma&Biotech substantially increased sales and CORE results compared with the same period last year. Ongoing strong momentum in commercial biologics over-compensated for the impact of restructuring activities in other areas. Bioscience Solutions also delivered a strong performance during the first half of 2015.

Lonza experienced firm market demand for commercial and clinical products, as well as for make-to-stock products. In addition to offering services to itsr customers in the company's multi-purpose plants, it now has begun offering suites with dedicated manufacturing capacity to give customers greater flexibility in determining production quantities and timings. Lonza's continuous quality updating not only supports our productivity targets, but also fulfills the company's customers’ requirements.

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)