Non-small cell lung cancer market to gain over $20 billion in value by 2025

It's anticipated that 65% of the total NSCLC market will go to immuno-oncology therapies.

The non-small cell lung cancer (NSCLC) market across the eight major markets (8MM) of the US, France, Germany, Italy, Spain, the UK, Japan, and China, is set to rise from $6.21 billion in 2015 to $26.71 billion by 2025, representing a very strong compound annual growth rate of 15.7%, according to research and consulting firm GlobalData.

The company’s latest report states that the impressive strength of the market over the next decade can be attributed to the increasing incorporation of premium-priced immune checkpoint inhibitors into the NSCLC treatment algorithm, the launch of new targeted therapies, and the rising incidence of the disease across the 8MM.

Cai Xuan, GlobalData’s Analyst covering Oncology, explains: “In 2015, the NSCLC space was largely dominated by generic chemotherapy and targeted therapies, which accounted for around 94% of the market, whereas immuno-oncology sales accounted for just 6%. In 2025, that trend will be reversed, with 65% of the total NSCLC market going to immuno-oncology therapies, and the remaining 35% being split between chemotherapy and targeted agents.

“A major trend in corporate strategy is the pairing of programmed cell death protein 1 (PD-1) checkpoint inhibitors with other agents. In the crowded PD-1 space, as drugs with identical mechanisms of action are launched, players are looking for ways to boost efficacy in hopes of differentiating their product from that of their competitors.”

Companies such as Merck, Roche, and Bristol-Myers Squibb are evaluating their PD-1 checkpoint inhibitors in combination with chemotherapies, targeted agents, and/or other immuno-oncology products.

In the targeted therapy arena, companies are developing novel therapies for previously unactionable mutations to address high unmet need in specific patient populations. For example, Kirsten rat sarcoma virus (KRAS)-mutant NSCLC makes up a significant (25–30%) share of the total NSCLC patient pool, yet there are no targeted therapies currently marketed for this segment of the population.

Xuan notes: “Eli Lilly’s pipeline agent abemaciclib targets KRAS patients, yet its lack of efficacy is expected to severely limit its uptake, leaving opportunities for other KRAS targeted therapies to enter the space.

“In addition to novel therapies, companies are also developing second- and third-generation targeted therapies to provide better options for patients with actionable mutations. GlobalData expects these next-generation targeted therapies to take significant patient share away from their predecessors.”

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

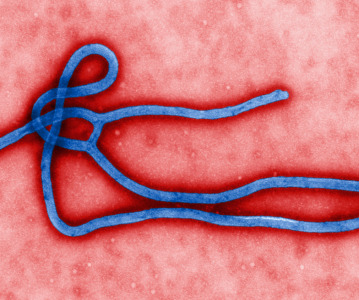

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)