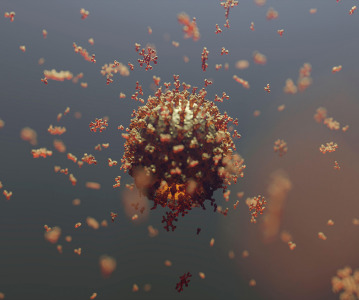

Recently-approved Descovy will help Gilead maintain dominance of HIV market in short term, says GlobalData

Despite its strong position in the HIV space, Gilead will face significant competition from Janssen and ViiV, as potentially successful outcomes of clinical trials could shift market dynamics.

The recent FDA approval of Gilead Sciences’ drug Descovy (emtricitabine/tenofovir alafenamide [TAF]) in the treatment of human immunodeficiency virus (HIV) will boost the company’s TAF-based HIV portfolio, and allow Gilead to stay on top of a fast-changing treatment landscape, according to an analyst with research and consulting firm GlobalData.

As explored in GlobalData’s most recent HIV report, the market will see major shifts in the types of treatments administered to patients in the next few years. Indeed, fixed-dosed combinations (FDCs) and single-tablet regimens (STRs) are transforming the HIV landscape, and tenofovir disoproxil fumarate (TDF) treatments are beginning to be challenged by clinically superior TAF-based therapies.

David Fratoni, GlobalData’s Analyst covering Infectious Diseases, explains: “The launch of Descovy means Gilead is now responsible for bringing three TAFs to the US market in less than six months, including Genvoya (elvitegravir/cobicistat/emtricitabine/TAF) and Odefsey (emtricitabine/rilpivirine/TAF). This commitment to building a strong TAF profile represents a remarkable milestone for Gilead’s fight against HIV, cementing its leading position in the arena for now.

“Such a strategy comes at an opportune time for the company, as it encounters the rise of generic HIV regimens and branded FDCs and STRs. In fact, Gilead will have to face US and/or EU patent expirations of two of its TDF-based HIV therapies, Viread (TDF) and Truvada (emtricitabine/TDF), beginning in 2017, which will stimulate the entry of multi-tablet regimens from various generics manufacturers.”

Gilead hopes to switch patients currently taking its TDF-based brands onto its next-generation TAFs over the next 6–12 months. Indeed, this will go a long way to protecting the company from imminent expiries, as it is expected that physicians will be in favor of this new regimen following a recent study showing that switching to TAF-based drugs is associated with maintenance of virological suppression, non-inferior virological efficacy, and overall tolerability.

Fratoni continues: “Ultimately, the biggest threat to Gilead is competition from companies offering other branded drugs, not from generic manufacturers. Specifically, the strongest competitors are ViiV Healthcare and Janssen, which are currently working on a number of new HIV treatments to supplement their already-strong portfolios.”

“Although GlobalData expects Gilead’s three TAF-based regimens to garner a solid portion of market share over the next few years, the potentially successful outcomes of Janssen’s and ViiV’s clinical trials could shift market dynamics, meaning pricing factors will be key to future US market sales.”

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)