Surge of Indian biosimilars market forecast in 2019

India predicted to be one of the world’s ‘fastest growing bio’ hubs in 2019, fuelled by new biosimilars production.

New data from CPHI shows that, despite ongoing reputational challenges, India’s biologics market is set for robust growth in 2019 driven by biosimilars production. The India-specific findings from CPHI’s bio league tables predict strong ‘bio growth potential’ in India throughout 2019 in the build-up to the 13th edition of CPHI India 2019, which will take place at the India Expo Centre in Delhi NCR.

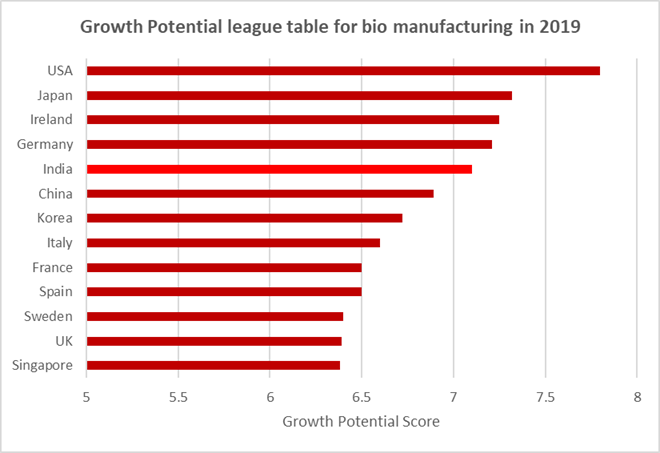

However, highlighting the market’s ambivalent reputation, India also received the second lowest overall scores for ‘quality of biologics manufacturing’ and ‘biologics innovation’. Yet for ‘growth potential’ India (7.05) scored extremely highly, finishing broadly level with the well-established advanced bio markets Germany (7.2), Ireland (7.2) and Japan (7.3), and behind only the US (7.8) – but significantly, ahead of China (6.9) and its widely documented rapidly expanding bio sector.

India’s growing biosimilars industry is the primary driver of growth, with respondents citing ‘India’s rising domestic demand, bio investments and the potential for increased exports to advanced markets’. Already, India has over 70 approved biosimilars in the domestic market (more than any other country) and market penetration – which is currently relatively low – is expected to increase quickly in 2019 as the middle classes increase demand.

This growth potential is augmented by government subsidies for production of biosimilars, expiration of existing biologics patents and India’s Central Drugs Standard Control Organisation aligning guidelines closely with other regulators such as the US FDA. In fact, the Associated Chambers of Commerce of India 2017 report predicts that the biosimilars market in India was worth $2.2bn and is expected to reach an astonishing $40bn by 2030.

Cara Turner, Brand Director, Pharma, commented: “CPHI and P-MEC India have been extremely successful and we announced before the event that India had secured the number one spot for growth potential of small molecules in 2019. These new findings however, show that biosimilars are also set for dramatic growth in 2019 and that India is expected to be amongst the fastest growing bio regions. In fact, over the next few years we anticipate seeing more bio machinery manufacturers attending P-MEC and a steady growth in our bio audiences.”

Demand in Europe and the US is expected to sustain longer term growth rates as these markets open-up further to biosimilar encroachment and encourage new entrants. Undoubtedly, the lower cost of manufacturing in India makes biosimilars exports attractive to Western markets. Initial market entry may be slowed by high clinical development costs – which can be as much as $150million for an approval in the US. As a result, it is predicted that in 2019 we will see a greater number of Western-Indian partnerships (aka the Mylan-Biocon model) jointly bringing new biosimilars to patients in both the EU and US.

The research highlighted that unlike its small molecule industry – which improved rapidly in the 2018 league tables – the bio industry in India is still viewed by international pharma as substantially behind the leading markets in terms of quality and innovation. Notably, the top ranked nations of the US, Germany, and Japan, and the second tier of advanced nations, Sweden, Ireland, Switzerland, the UK, France and Korea.

The relatively low score for both quality (6.0) and innovation (6.0) is probably reflective of the lack of any patented biologic development in India, with the majority of this work being retained in Europe and the US. However, the nation did score intermediately for ‘knowledge of its bio professionals’ (6.6) and its ‘ability to meet future capacity requirements’ (6.7) – suggesting that there is more than adequate facilities built or under construction to meet rising future demand.

After the huge success of the 2018 event, CPHI & P-MEC India 2019 will be returning to the India Expo Centre in the nation’s capital for the second time and Rahul Deshpande, Group Director, UBM India added; “What is most exciting is that we’ll be returning to a single site event taking place in the nation’s capital Delhi, bringing together regulators, industry and international pharma in what will have been a record-breaking year for the pharma industry in India. ”

Related News

-

News Pharmapack Awards 2024 Patient-Centric Design Award Winner – Dr Ferrer BioPharma

The 2024 Pharmapack Awards celebrated the best in innovation and design for the pharmaceutical packaging and drug delivery industry on January 24, 2024. -

News Women in Pharma: Minding the Gap at Pharmapack 2024

2024 marks the first year Pharmapack will host a Diversity track dedicated to bridging the gap within the pharmaceutical packaging and drug delivery sector. The track includes a panel discussion on 'Enabling Diversity in the Workplace,' focused... -

News Pharmapack Awards 2024 - Celebrating Packaging and Drug Delivery Innovation

The 2024 Pharmapack Innovation Awards ceremony celebrated the best in pharmaceutical packaging and drug delivery innovation at all levels. The awards were held on January 24, 2024 at the Paris Expo Porte de Versailles. -

News 2024 Pharma Industry Trends Outlook: Collaboration, Market Maturity, and Digital Futures

The annual CPHI Online 2024 Pharma Trends Outlook, in partnership with Arvato Systems, identifies 12 key industry trends shaping the life sciences industry in the coming year. -

News New Novo Nordisk AI hub for drug discovery to open in London, UK

Danish pharmaceutical giant Novo Nordisk will be opening an AI-based research facility in the heart of London to advance drug discovery operations. -

News BioNTech to begin mRNA vaccine manufacturing in Rwanda by 2025

German biotechnology company BioNTech has stated their intentions to begin production at their mRNA vaccine factory in Rwanda by 2025, which will mark the first foreign mRNA vaccine manufacturing site on the continent of Africa. -

News Women in Pharma: Looking back on 2023 and moving forward to 2024

In this monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. -

News CPHI Barcelona 2023: Partnering for Success – Managing Outsourcing Relationships to Optimise Manufacturing Operations

During CPHI Barcelona 2023, insightful content sessions offered attendees the chance to explore trending topics with expert speakers and panellists. Here, we summarise what the pharma industry and supply chain are talking about the most.

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance