2010: The little IPO engines that usually couldn't

Every year everybody who's anybody in biotech--and a lot who aren't--goes to the JP Morgan conference in San Francisco in January.

Every year everybody who's anybody in biotech--and a lot who aren't--goes to the JP Morgan conference in San Francisco in January. This year the talk quickly turned bullish as biotech execs and investors wanted to believe that the IPO was making a comeback.

But that buzz didn't last long.

A spate of IPOs early on ran into an ugly reality: Investors just really weren't all that excited by the classic, money-losing biotech. Red ink, even if it was spilled in pursuit of solid data, was not a trendy color this year. Even Ironwood Pharmaceuticals, an ambitious developer with a clear shot at a near-term FDA app, had to cut its price significantly to complete its offering. And as we headed into the new year, its shares were trading below its $11.25 IPO price.

Smaller biotechs that faced even bigger development risks, a common condition in this industry, faced an even tougher reception on Wall Street. When Pacific Biosciences actually managed to price its IPO in

Related News

-

News Women in Pharma: Hiring Across the Gender Divide

In our monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. -

Sponsored Content Ashwagandha and Herbal Medicines: Pharma’s Next Big Opportunity

Herbal medicines and nutraceuticals have seen a surge in interest since the onset of the COVID-19 pandemic. Driven by patient interest in prioritising personalised and integrative medicines, the herbal ingredients industry is now faced with concerns pe... -

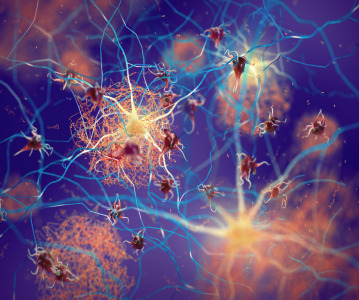

News Identifying Alzheimer’s Disease biomarker proteins with whole blood tests

A University of Manchester spin-out pharmaceutical company, PharmaKure, has reported successful study results for the quantification of Alzheimer’s Disease biomarker proteins with a whole blood test. -

News Bill & Melinda Gates Foundation to boost mRNA vaccine initiatives in Africa with USD $40m

To address vaccine inequality and accessibility issues, the Bill & Melinda Gates Foundation aims to deliver USD $40m to various biotech companies and vaccine manufacturers in support of mRNA vaccine development. -

News Updated – Changing abortion pill access according to the US FDA and Supreme Court

After the approval of the medical abortion pill, mifepristone, by the US FDA, states across the USA approach the distribution of the pill differently, some ruling against allowing access to the drug. -

News Revolutionising cancer treatment with mRNA-based therapeutics

Global market for mRNA-based oncology therapeutics expected to reach USD $2 billion by 2029, with promising results for the combination of mRNA candidates with immune checkpoint inhibitors to treat solid tumours. -

News Breaking Barriers: Innovations in Oral Solid Dose Form Bioavailability

The effectiveness of a medication often hinges on its bioavailability – the rate and extent at which the active ingredient is absorbed into the bloodstream. When it comes to oral solid dose forms, such as tablets and capsules, the challenge lies ... -

News Choosing the Right CDMO Partner: A Comprehensive Guide

Finding the right partner for the development and manufacturing of your pharmaceutical or biopharmaceutical products is paramount. This is where Contract Development and Manufacturing Organizations (CDMOs) step in, offering their expertise and infrastr...

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)