Diversifying Supply Chains — Does USMCA Offer New Opportunities for Pharma?

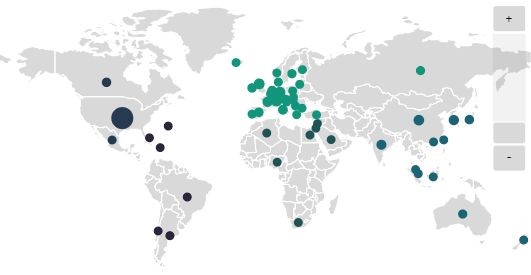

Concentration of Pharmaceutical Contract Manufacturing Agreements, 1 January 2020 - 7 May 2021, by CMO Location. GlobalData Pharmaceutical Intelligence Center Deals Database, accessed 7 May 2021. © GlobalData

Dependence on Asia – and specifically China – has been the subject of a great deal of attention by political and industry leaders in the last year. In North America, this has led to calls to “reshore” drug production to domestic facilities.

But just how realistic is reshoring America’s drug supply? And what role, if any, could the US-Mexico-Canada Trade Deal (USMCA, the successor to NAFTA) play in making it a reality?

The COVID-19 wake-up call

The vulnerability of drug supply chains became starkly apparent in February of 2020, when supply shortages, lockdowns, and trade restrictions began to impact pharma companies worldwide. Talk of supplier diversification quickly escalated during the scramble to satisfy the demand that followed. “Since the beginning of the pandemic, supply-chain resilience has been top-of-mind for companies up and down the pharmaceuticals value chain from key starting materials (KSMs) and intermediates suppliers to manufacturers and consumers,” says Paul Hirsh Senior Vice President, Industry Development & Strategic Partnerships for the Society of Chemical Manufacturers & Affiliates (SOCMA). “The industry is also working with regulators to meet a growing domestic need by looking for ways to expand domestic manufacturing opportunities and overcome challenges.” Talk of “reshoring” isn’t new Efforts to encourage more domestic production were already underway before the pandemic. “The issue of U.S. dependency on KSMs and active pharmaceutical ingredients (APIs) specifically manufactured offshore had been raised by a number of U.S. government agencies and Congress,” Hirsh recalls. At that time, both the White House and Capitol Hill were drafting executive orders and legislation to promote ‘Made in America’ pharma initiatives. “Much of this was spurred by concerns that the U.S. was too dependent on foreign manufacturing of API, FD, and KSM,” Hirsh says. “Additionally, while there was significant focus on volumes coming from offshore, the actual quantities were unknown. As a result, a subsection of the CARES Act addresses volumes.” Political rhetoric vs. supply chain reality While demands for bringing pharma production “back” to North America have frequently made headlines, several obstacles stand in the way. Economic factors are particularly strong — not only on the pharma industry’s bottom line but in consumers’ desire for low drug costs. While the pandemic clearly showed that supply chain weakness could pose a threat to both of these goals, reshoring alone may not be the logical answer. “Political rhetoric about reshoring was occurring before the pandemic, distinct from actual changes to the supply chain,” says Fiona Barry, Associate Editor for GlobalData PharmSource. “We have not seen evidence of a significant volume of pharma manufacturing moving from Asia to North America. If anything, the pandemic has shown the need for diverse supply chains that use multiple suppliers, in case of manufacturing or distribution problems in one location.” Barry notes that many industry sources have criticized attempts to limit the use of foreign supply chains. That said, the pandemic has awakened a strong political appetite in the U.S. for pushing for more domestic manufacturing of essential drugs and vaccines. While some efforts are underway to mitigate vulnerability in this way, major changes aren’t likely to happen overnight and will continue to be balanced with economic realities. “Finding new suppliers and manufacturers can, in some instances, take years,” Hirsh says. “Considering agreements in place and regulatory regimes — both domestic and regional — are part of any procurement decision. Changes can take anywhere from three to seven years, depending on whether the company is expanding and refurbishing existing facilities or building new ones. Any timeline needs to account for the planning, execution of the plan and then approval by the FDA and any State authorities that may govern construction and the types of products being produced.” “The majority of small molecule API manufacturing facilities are located in China and India,” Barry adds. “Shifting all this production to the U.S. would be a huge undertaking and brings its own risks. The Pharmaceutical Research and Manufacturers of America (PhRMA) has noted that policy proposals that would mandate drastic changes to pharmaceutical manufacturing supply chains underestimate the significant time, resources and other feasibility challenges and complexities involved.” In addition, the construction, outfitting, and regulatory qualification of facilities can take years even after funding is secured. For this reason, some companies are repurposing existing plants rather than building new ones. In the meantime, the growth of Asian supply deals shows no sign of slowing in the immediate future – including large molecule biopharmaceuticals, once a mainstay of U.S. drug production. “Biopharma companies sign more outsourcing agreements with contract manufacturing organizations (CMOs) in North America than in the Asia-Pacific (APAC) region — between two and three times as many in 2020,” Barry says. “However, the number of these contracts is increasing year on year for both regions, indicating that both regions continue to have healthy pharmaceutical manufacturing industries supplying the world’s medicines. In 2020, North America had 7% more of these manufacturing agreements than in 2019, while APAC contracts grew by a huge 74%.” Will the USMCA have an impact? The FDA was closely involved in the renegotiations that led to the USMCA trade deal, resulting in several changes impacting the pharma industry. According to Barry, the results are mixed: “The final pact removed a provision in an earlier draft that would have extended biologics’ marketing exclusivity in Mexico and Canada to ten years. It’s currently five and eight years, respectively. That’s bad news for makers of innovator biologics and good news for biosimilar makers,” she says. “There are no specific incentives for pharmaceutical manufacturing in the USMCA,” Hirsh says. That said, many of the provisions included in the agreement are designed to promote greater market access, regulatory harmonization, and the convergence of standards. For the generic and biosimilar industry, USMCA’s importance is the fact that it is the most balanced agreement in terms of pharmaceutical intellectual property, promoting both innovation and a competitive off-patent market.” Learn more about this topic at CPHI North America in the session The Cost of Bring Manufacturing Home Fiona Barry is speaking at CPHI North America in the session Innovation in the Race to Develop COVID-19 VaccinesRelated News

-

News On Track at Pharmapack 2024 - The Track Sponsor interview: BD Pharmaceuticals

January 2024 brings both a new year and Europe’s leading packaging and drug delivery event. Bringing the world’s experts in pharmaceutical packaging together in Paris, France, Pharmapack 2024 brings exciting opportunities to learn and colla... -

News Patients vs Pharma – who will the Inflation Reduction Act affect the most?

The Inflation Reduction Act brought in by the Biden administration in 2022 aims to give better and more equitable access to healthcare in the USA. However, pharma companies are now concerned about the other potential costs of such legislation. -

News Roche breaks into the obesity drug market with the acquisition of Carmot Therapeutics

In a bid to diversify their therapeutic offerings, Roche takes over Carmot Therapeutics in $2.7 billion deal, with one obesity drug spearheading the venture into the field as they prep for a Phase II in-human trial. -

News Biden backs Cold-War measures to shore-up medical supply chains

In a recent strategy to combat rising inflation and the cost of living crisis, President Joe Biden has invoked a Cold War-era act to increase investment in a selection of medicines and supplies. -

News Women in Pharma: Delivering solutions for gender diversity

In our new monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. -

News CPHI Barcelona Speaker Interview – What the US FDA’s Quality Management Maturity Means for the Pharma Industry

At CPHI Barcelona (24–26 October, 2023), we spoke to Sireesha Yadlapalli, CEO of Pharmatech Associates, who gave a presentation on the implications of the US FDA’s Quality Management Maturity (QMM) Initiative, and spoke on the panel of the ... -

News CPHI Podcast Series: What does the changing US Pharma market mean for industry and patients alike?

In this week's episode of the CPHI Podcast Series Lucy Chard, Digital Editor for CPHI Online is joined by James Manser to discuss the political and market changes in the US pharma field. -

News Wegovy and weight-loss drugs driving demand for manufacturers that can fill syringes

Injectable weight-loss treatments are prompting contract manufacturers to invest and include fill-finish services into their service portfolios, in a bid to attract pharmaceutical giants developing drugs similar to Novo Nordisk's Wegovy.

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)

.png)