How to improve patient outcomes: consider ocular implants

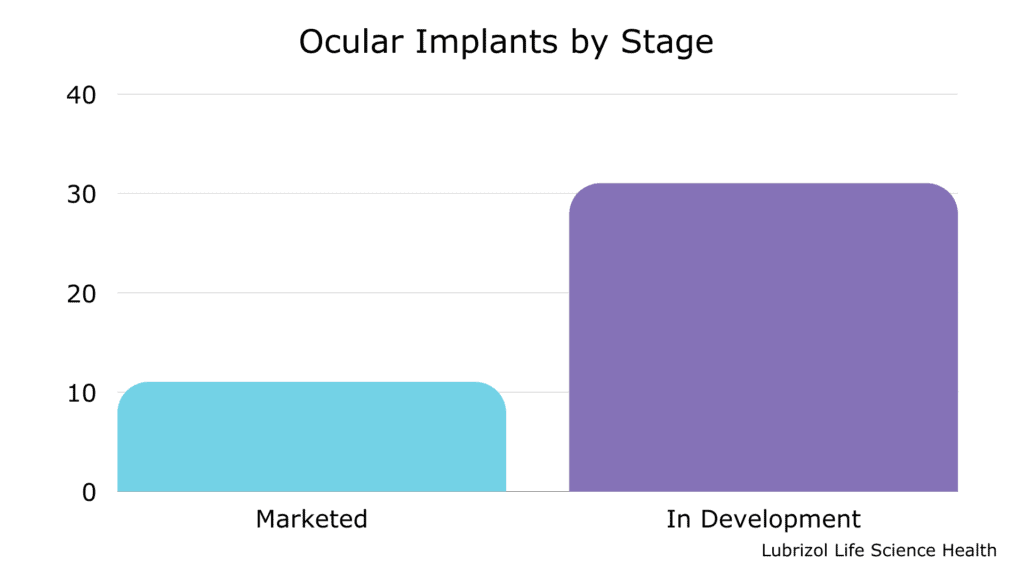

Did you know that there are already 11 ocular implants on the market, and over 30 in development? (See Table 1 and Figure 2)

Every year, more and more people live with eye disease or vision impairment of some kind, requiring treatment to avoid additional vision loss or blindness.

In 2010, approximately 4 million people had some kind of vision impairment, a number expected to climb to roughly 7 million by 2030 and more than 12 million by 2050. Cases of macular degeneration alone — which grew 18% from 2000 to 2010 - are expected to more than double by 2050.

That growth, spurred in part by an aging population, creates new demand and opportunities in the ocular pharmaceutical space.

Ocular implants — small devices designed to be inserted into the eye and deliver a drug locally over an extended period — are rapidly gaining ground as a treatment option. As patients continue to seek out convenient, less invasive treatments, the demand for these implants will continue to increase.

Figure 1. Quote on incidence of vision impairment

Types of ocular implants

Ocular implants present a unique solution to the challenges of treating posterior eye disorders, and many are already commercially available, including Allergan’s Ozurdex® dexamethasone intravitreal implant and Allergan’s DurystaÔ bimatoprost implant, prescribed for a range of posterior eye conditions.

Broadly, ocular implants come in both biodegradable (bioresorbable) and non-biodegradable (biodurable) forms.

- Bioresorbable implants are inserted into the patient’s eye and safely absorbed by the body over time. These implants combine a drug with a polymer — often polylactic-co-glycolic acid (PLGA) — which degrades over time, releasing a drug.

- Biodurable implants do not break down over time and may be removed or refilled once the treatment is complete. These implants often encapsulate a pharmaceutical inside a polymer — such as Lubrizol’s Pathway™ thermoplastic polyurethane (TPU), ethylene vinyl acetate (EVA), or silicone.

Each type of implant has advantages and disadvantages. Bioresorbable implants eliminate the need for patients to undergo a follow-up procedure, but they may not be suitable for use with all drugs. Biodurable implants can offer longer, more controlled drug release, but they may require patients to undergo a second procedure to remove them.

Overall, however, implants present a significant improvement for patients, and require less frequent administration than ocular injections. When treated with an implant, patients who had previously relied on traditional injections could extend their time between treatments by weeks or even months.

Table 1. Ocular implants currently in development

Considerations when developing ocular implants

The advantages and demand for ocular implants are clear, but developing and producing them requires several types of special expertise. Companies looking to outsource the development or manufacturing of these products are well advised to partner with an organization experienced with long-acting dosage forms, and in handling every aspect of ocular products, from polymer selection to aseptic manufacturing.

Sterility Assurance

Drug product manufacturers must ensure that an ocular product is sterile as the eye is particularly sensitive to bacteria, pathogens, and other irritants. Terminal sterilization via heat, chemical gas, or irradiation is the preferred means of achieving a sterile product. However, in cases where a drug or formulation component is not amenable to these techniques, aseptic manufacturing is required.

Regardless of sterilization technique, ophthalmic implant developers must have a strategy for achieving a sterile product, including access to the appropriate manufacturing facilities and an understanding of the regulatory requirements around sterility assurance.

Polymer Selection

Whether implants are biodurable or bioresorbable, they rely on pharmaceutical-grade polymers (excipients) to achieve effective sustained release. Implant developers should ensure that polymers can be manufactured according to Good Manufacturing Practices (GMP) and pass the appropriate biocompatibility tests.

In addition, some polymer suppliers support their products with Drug Master Files (DMFs), which provide further information to regulatory agencies and support drug filings. Lubrizol’s PathwayÔ TPU meets all these requirements and presents several technical advantages over other polymers, including better customization of chemical and physical properties. However, other materials may also be appropriate for certain applications. The CDMO division of Lubrizol Life Science Health (LLS Health) supports clients by selecting the most suitable polymers for their product whether or not Lubrizol supplies it directly. LLS Health’s experience spans nearly all commercially available bioresorbable and biodurable polymers and several novel excipient chemistries.

Figure 2. Graph on ocular drug products by stage

Implant Manufacturing

Creating implants that are smaller than a grain of rice requires extreme precision throughout development, prototyping, and production. Consistent manufacturing processes are especially important for ocular implants, as even small changes in drug concentration or implant dimensions can result in drastic differences in product performance.

Ocular implants are frequently made via thermal processing methods such as hot melt extrusion or injection molding, which begins with the compounding step. During this process, a drug and polymer melt and blend together in an extruder.

To ensure a homogenous blend, the polymer may require pre-processing, such as milling polymeric pellets into powder form. Equipment for milling and extrusion can be scaled to meet production needs from R&D through manufacturing.

Once the polymer and drug are combined, they pass through an additional extrusion or molding step, in which heat and pressure form the final implant. For rod-shaped matrix implants, the drug-polymer blend may pass through an extruder to form a filament before being cut to form the final product. Reliable compounding and precise extrusion/cutting are crucial for products manufactured via extrusion.

To achieve better control over drug release, implant developers may also create core-sheath systems using biodurable polymers and a co-extrusion technique. Co-extrusion involves the simultaneous extrusion of a drug-loaded core surrounded by a rate-controlling polymer membrane. A specially designed extrusion head is fed by two perpendicular extruders – one supplying the core composition and the other supplying the sheath material. By controlling the core and sheath polymers, sheath thickness, and drug loading, implant developers can tune the drug release to specific targets. This technique has been used to manufacture intravaginal rings that deliver precise levels of drug for months at a time, and experienced scientists can control sheath dimensions down to the micron-level.

Some biodurable implants use silicone, which relies on a different set of mixing, molding, and curing steps to achieve a final dosage form (as opposed to the thermal processes described above). Silicone has long served as a reliable material for medical devices and may offer a suitable alternative to extrusion when a drug is sensitive to elevated temperatures. However, other biodurable polymers offer additional benefits, including increased drug loading or more control over drug release.

Whether the desired ocular implant is biodegradable or biodurable, a drug developer must select a partner with knowledge of API-polymer interactions and the correct equipment to develop and manufacture their product in a GMP environment. A manufacturing partner with experience in long-acting and ocular dosage forms can leverage their experience to reduce development cycles and avoid costly errors in scale-up/manufacturing.

The CDMO division of LLS Health has extensive expertise in a number of polymer processing techniques, including precise co-extrusions, and working with all ophthalmic dosage forms.

LLS Health’s longstanding history of supplying polymers, developing implantable drug delivery systems, and carrying out aseptic production help its partners overcome many of the barriers to developing ocular implants.

Contact us to learn more about Lubrizol’s role as a partner and leader in the ophthalmic space.

Related News

-

News Pharmapack Awards 2024 Patient-Centric Design Award Winner – Dr Ferrer BioPharma

The 2024 Pharmapack Awards celebrated the best in innovation and design for the pharmaceutical packaging and drug delivery industry on January 24, 2024. -

News Pharmapack Awards 2024 - Celebrating Packaging and Drug Delivery Innovation

The 2024 Pharmapack Innovation Awards ceremony celebrated the best in pharmaceutical packaging and drug delivery innovation at all levels. The awards were held on January 24, 2024 at the Paris Expo Porte de Versailles. -

News Women in Pharma: Looking back on 2023 and moving forward to 2024

In this monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. -

News On track at CPHI Barcelona - The Track Sponsor interview: USP

In our packed out content sessions at CPHI Barcelona this year we focus on some of the hottest topics coming up in the pharma industry, with each track sponsored by a leading expert in the field. -

News Women in Pharma: Marketing for the other half in healthcare

In our new monthly series, we interview women from across the pharmaceutical industry and supply chain to discuss the importance of gender diversity in healthcare, the workplace, and beyond. This instalment highlights not only the importance of ma... -

News Bringing the pharmaceutical supply chain closer to home

The pharmaceutical supply chain has encountered numerous disruptions in the last few years, impacting procurement, manufacturing, packaging, and distribution operations within the pharmaceutical industry. Read about the rise in calls for near/resh... -

News Delivering on mRNA-based therapeutics: innovations in applications and packaging

Since the onset of the COVID-19 pandemic, the innovative potential of mRNA vaccines and therapeutics has raised questions regarding their manufacturing, packaging, and storage/transportation. Learn about how the pharmaceutical supply chain is meet... -

News Your Prescription for Marketing Success: Digital Pharma Marketing Toolkit – Free eBook

Download your FREE pharma marketing eBook to learn why it is so important for pharmaceutical marketeers to develop their digital content marketing strategies in order to establish their companies as thought leaders and industry experts.

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance