Propharma: The World's Largest RCO

RCO Vs CRO: Drug and Device Development Outsourcing 2.0

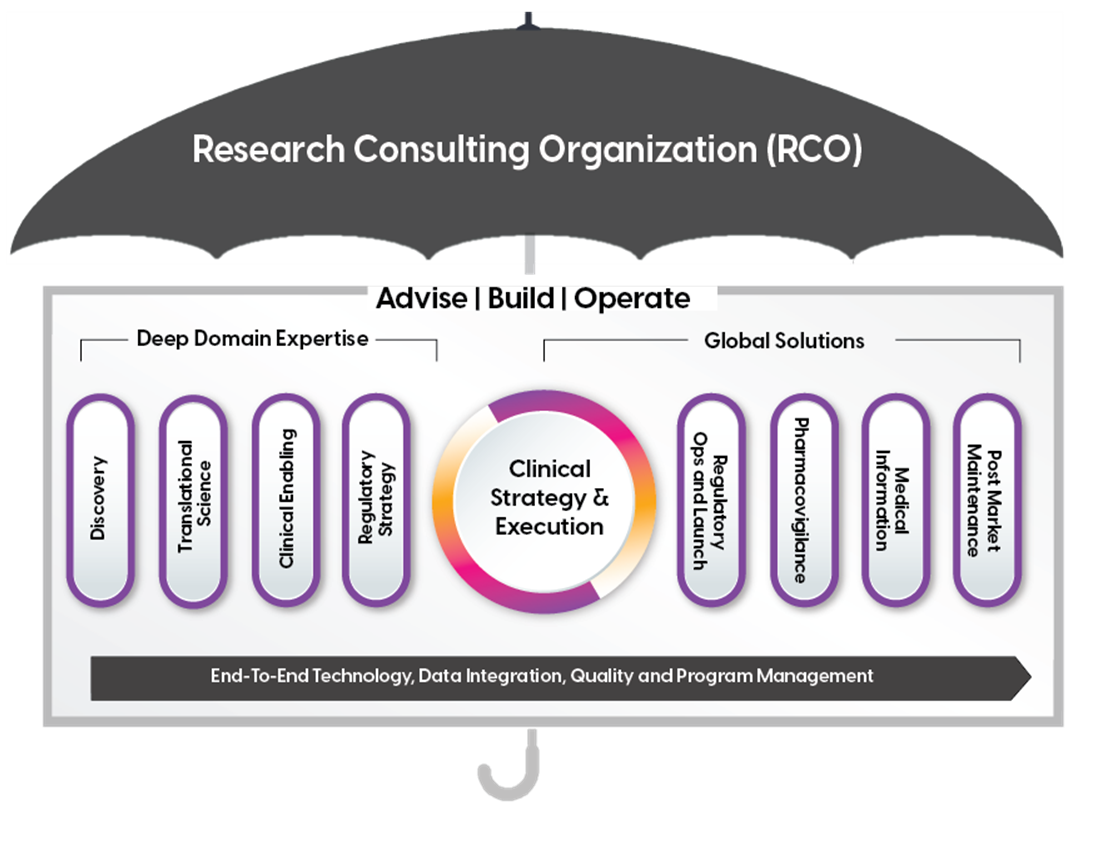

Traditional CRO push a full-service, "cookie-cutter" agenda, offering little compromise for the small Sponsor; ProPharma’s Research Consulting Organization RCO model leads with strategy to help de-risk programs and create tailored solutions to maximize probability of success.

ProPharma has transformed its organizational structure and solutions to put its clients at the very center. We offer a suite of bespoke consulting solutions across service lines and functional areas of expertise to span the full product life cycle. ProPharma embraces partnerships to reduce delays and drive consistency with dedicated and experienced strategists and program managers for end-to-end oversight.

Drug and Device Development Outsourcing 2.0 - Soaring Beyond the CRO

Sponsors are constantly focused on moving their products from development through commercialization as quickly and efficiently as possible. Historically, biotech, pharma, and device companies have largely depended on the hope that the science works and that a traditional clinical research organization (CRO) model is the "best fit" to reach the finish line. With the shifting landscape, a new degree of personalization and agility is required, one that is not typically available with rigid CRO models. To meet this need, a new service partner has emerged to make success easier and more certain: the Research Consulting Organization or RCO.

The CROs Paradox

Since the 1990s “faster, better, cheaper” has been the mantra of life science innovators looking to advance an asset from development to commercialization as expeditiously and responsibly as possible. Clinical research organizations (CROs) have answered the call; fitting themselves operationally to support the industry’s blockbuster ambitions and creating the rigidity in delivery models we observe today. This model favored the largest biopharma companies that could offer the volume and long-term partnerships that made the economics work.

What about the small and midsize (SMID) innovators focused on rare diseases, new devices, and other programs? Historically, they have found themselves relegated to the end of the queue, piecing together pivotal programs with the CRO’s “C” team. When coupled with an unprecedented talent shortage across the industry, the situation for these SMID innovators has become untenable, forcing suboptimal partnering decisions, budget overruns, and delaying action. In addition, investor pressure must contend with an 80% probability of delay and 16% overburn in clinical trial delivery1. With smaller rare disease programs representing 40% of the industry’s pipeline, the "bigger-the-better" CRO trend has become incongruent with market needs. This provides an opportunity for the industry to embrace a new service partner: the Research Consulting Organization or RCO.

Trapped in scale-based economic models and the “need volume to make the numbers work” mindset, traditional CROs are stuck; often solving for "shift-to-nuance" by pushing extraneous services to help drive appeal (and margin). Paradoxically, although the clinical trial – the center of a CRO’s universe – might be the largest cost for a development stage company, it’s the “nuances” that Sponsors need that often have greater impact. Chemistry, Manufacturing, and Control (CMC) concerns, along with validation, product profile, and regulatory strategy issues frequently have more long-term importance on a program’s success than the clinical trial itself.

Many CROs have tried to solve this by creating biotech arms to focus on the needs of smaller programs; however, these business units are still held accountable to the same economic frame as their larger counterparts and compete for the same internal (and external) resources. Meanwhile, smaller programs with challenging drugs, devices, or cell therapies still need one-of-a-kind responses that are designed to quickly move them through the development process and regulatory paradigm with the same consideration for cost-effectiveness.

Answering the call, what does the client need?

Ironically, the solution can be found in the pre–mega-merger CRO industry’s history. Rewind a few decades to the CRO “big bang"; CROs quickly gained favor as the functional outsourcing solution for the pharmaceutical industry, with clinical monitoring as the most common starting point. These companies had a rapport with investigators and site staff. For example, the front-line role of a field-based clinical research associate (CRA) was expansive. They held accountability over their sites and felt ownership across the delivery of a study.

As these companies grew and as the outsourcing model proved itself from a cost and quality perspective, CROs had to find ways to be more efficient and scale operations. Responsibilities that were once under the umbrella of a single person, like the CRA, were distributed across several functions, creating a disjointed feel to an intended end-to-end, full-service experience. It used to be that one size did NOT fit all, but today, this is a differentiator.

Today, full-service solutions have taken the front seat in the traditional CRO’s portfolio followed by Functional Service Provider (FSP) solutions, which offer discrete functional services.

At ProPharma we have built a fit-for-purpose solution with the resources each Sponsor needs.

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance