GSK to divest ofatumumab for auto-immune indications to Novartis for up to $1 billion plus royalties

GlaxoSmithKline (GSK) has announced an agreement with Novartis Pharma AG (“Novartis Pharma”), a subsidiary of Novartis AG, to divest its rights in ofatumumab for auto-immune indications, including multiple sclerosis.

Novartis Pharma previously acquired the oncology indications for ofatumumab (Arzerra) as part of the major three-part transaction between GSK and Novartis that completed earlier this year. After completion of the transaction, Novartis Pharma will own rights to ofatumumab in all indications.

The consideration payable by Novartis Pharma to GSK may reach up to $1,034 million and comprises a series of milestone payments as follows:

• $300 million payable at closing

• $200 million payable subject to the start of a Phase III study in relapsing remitting multiple sclerosis by Novartis

• further contingent payments of up to $534 million payable on the achievement of certain other development milestones.

Novartis Pharma will also pay royalties of up to 12% to GSK on any future net sales of ofatumumab in auto-immune indications.

David Redfern, Chief Strategy Officer at GSK, said: “We are pleased to have completed this transaction to divest the remaining rights in ofatumumab, crystallising significant additional value for GSK shareholders. We continue to focus on progressing our pipeline in core therapy areas including HIV, oncology, vaccines, cardiovascular, immuno-inflammation and respiratory diseases. We believe GSK’s pipeline has significant potential to drive long-term performance for the Group and will be profiling it further at our R&D event in November.”

This agreement with Novartis Pharma is subject to the expiry of any waiting period under the US Hart-Scott-Rodino Antitrust Improvements Act of 1976 and other customary closing conditions. The transaction is expected to complete by the end of 2015.

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

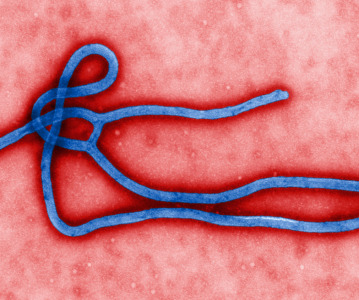

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)