Global medtech revenues reach all-time high, yet innovation investments lag

An increasing number of AI algorithms are now approved by the US Government – a trend that is set to continue as understanding of AI matures.

The global medical technology (medtech) industry continues to grow, but its long-term growth outlook is at risk due to underinvestment in R&D and lack of collaboration between industry providers, payers and patients.

The 2019 EY medtech report, Pulse of the Industry, has found that in 2018-2019 the industry's collective revenues increased by 7% to US$407.2b, representing medtech's third consecutive year of growth and the highest revenues recorded to date. Valuations were also robust, as cumulative public valuation rose by 38% in the 18 months to 30 June 2019, far outpacing the broader life sciences industry.

While R&D spending increased 11% in 2018, showing promise after a disappointing 2017, uncertainty remains as to whether this rebound signals the beginning of sustained re-investment. The report also notes that cash returned to shareholders increased, with medtech companies returning US$17b to investors in buybacks and dividends – more than the R&D investment total of US$15b.

Pamela Spence, EY Global Health Sciences and Wellness Leader, says: "Medtech remains exciting, as industry players continue to unlock the power of data to offer personalized treatment for more effective and faster patient outcomes. An increasing number of AI algorithms are now approved by the US Government – a trend that is set to continue as our understanding of AI matures. Consolidation into therapeutic areas also continues to build scale, driving companies to be more competitive, while collaboration with non-traditional partners to access diverse skills and talent will be critical to building a cybersecure ecosystem for data exchange between devices or products."

With the absence of a linked-up ecosystem, medtechs cannot extract the full value from the connected devices they create, the report finds.

Jim Welch, EY Global Medtech Leader, says: "Medtechs have a unique opportunity to capitalize on digital transformation. As devices become increasingly connected, medtech companies have a built-in advantage. They also have strong alignment with other health care ecosystem stakeholders, so they are well-placed to develop new business models and create value in the future. What they don't have are broad, in-house capabilities to develop personalized health care offerings. Increased investment in digital collaborations that expand customer experience, as well as data and analytics capabilities, will continue to move medtechs closer to patients."

The report further highlights that medtech companies are continuing to optimize their portfolios to prepare for future growth by shedding non-core assets and increasing capital efficiency. Investment opportunities in the US$500m to US$1b range are limited, exposing the sector to intense competition in innovative fields such as robotic surgery platforms. The report notes that, aside from a small number of megadeals, the total value of mergers and acquisitions is similar to the previous period, albeit spread over a much larger number of deals – indicating that medtechs are prioritizing tuck-ins and portfolio optimization, rather than bold or transformative deals.

Other key findings highlighted in the report include

Related News

-

News Eli Lilly gets ready to launch five new drugs in 2023

Eli Lilly, the American pharmaceutical company (IN, USA) are gearing up for a big year ahead, with hopes to launch five new drugs and capitalise on growing obesity and Alzheimer’s disease markets. -

News Amgen buys Horizon for $27.8 billion in bold step into the rare disease market

Amgen Inc buys pharmaceutical company Horizon Therapeutics in a multibillion-dollar deal, in hopes to capitalise on it's portfolio of drugs in the highly sort after rare disease market. -

News Pharma Supply Chain People Moves

The latest appointments and promotions across the pharmaceutical supply chain. -

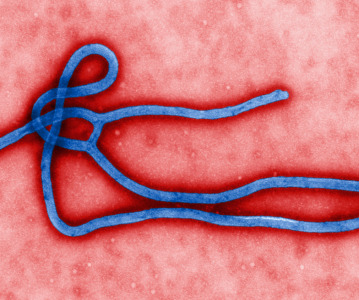

News Merck to donate new Ebola vaccine to defend against outbreaks in Uganda

Pharmaceutical giant Merck has announced they will be speeding up the processing of a new vaccine against the latest strain of the Ebola virus, to be donated to a global non-profit organisation for distribution -

News CPHI Podcast Series: Driving innovation with pharmaceutical startups

The latest episode in the CPHI Podcast Series explores how startups are driving innovation by taking high-risk approaches and doing business with greater agility. -

News Greener and efficient processes: Quaternary Ammonium Salts

Quaternary Ammonium Salts play a crucial part in Organic Chemistry processes at many major industries. Discover why.

-

News Biosimilars save patients $11B annually, but barriers to adoption remain in US market

Biosimilars introduce competition into the biologics market, driving down prices and increasing patient access. -

News WHO recommends use of two monoclonal antibody treatments against Ebola

The health body recommended use of treatments by Regeneron and Ridgeback Bio

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

.png)